Small business

owners don't need to purchase expensive business accounting software programs

or spend hours lost in complicated reports. Any accounting software will

provide the basic applications for accounting tasks, but packages designed for

small office owners and manager tend to simplify the process and provide

essentials that include a general ledger, the capability to create detailed

invoices or view business inventory and purchase history. Cloud accounting services-software

stored and accessed online-is an attractive option for small business owners.

When using cloud accounting software, IT tasks such as version upgrades and

data backup are managed by the application vendor. The main requirement is the

internet availability to access those applications.

FreshBooks features options for online payments, expense

tracking, time-tracking and accounting reports and taxes. Highlights include

customizing invoices, sending late payment reminders, automatic and

recurring-expense tracking, managing different rates for multiple projects and

profit/loss reports.

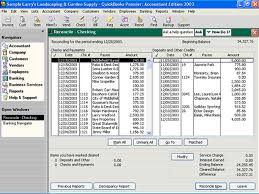

QuickBooks

is synonymous with small business accounting. While a number of standalone and

hosted versions are available, QuickBooks Online Simple Start is a good value

for small office accounting needs.

Kashoo features for the small business include

connecting to online bank accounts and credit cards, professional invoices,

simple dashboards and options to categorize income and expenses specifically

for tax reporting. In addition, you can easily share your business data with

your accountant online. Finally, Kashoo boasts secure, double-entry accounting

for bank reconciliation and financial statements.

Kashoo features for the small business include

connecting to online bank accounts and credit cards, professional invoices,

simple dashboards and options to categorize income and expenses specifically

for tax reporting. In addition, you can easily share your business data with

your accountant online. Finally, Kashoo boasts secure, double-entry accounting

for bank reconciliation and financial statements.

Outright is an easy-to-use cloud accounting system that

lets small business ecommerce owners organize and keep track of sales and

finances in one place. At a glance, you can see where money is going, view

profit/loss statements and see who your customers are. You can link existing

accounts such as banks, credit cards, Paypal, eBay, your own Web store or

FreshBooks to Outright, and you can import your existing transaction history.

From then on, Outright downloads your new data each day. Another useful

feature: Outright organizes all of your data into IRS-approved tax categories,

potentially lowering the workload and headache level at tax time.

your blog is very informative according to the travel and expense management . Thanks for providing us such a nice blog.

ReplyDeleteautomated expense management

You are welcome Steve.

ReplyDelete